There’s one thing about equity analysts talking up Tesla and getting behind the hype: equity investors enjoy the upside if their optimistic scenarios come true.

But bonds have only downside, and rating agencies are supposed to analyze various scenarios – the good the bad and the ugly – in coming up with bond ratings.

It doesn’t look like Moody’s did that when rating Tesla B2 and Tesla’s $1.8 billion bond issue B3 in August 2017. Rather, they assumed as true Tesla’s optimistic production targets (or hopes) for Tesla’s Model 3 and rated Tesla based on those coming true. To exaggerate how bizarre this approach is, had Tesla said they hope and expect to produce a million cars a day, perhaps Moody’s would have rated them Aaa! Click, whirr.

Crucially, Moody’s provided Tesla, the company and its bonds, ratings based on a picture of its future financial that exceeded its true financial position, before Tesla had met the goals that would warrant the rating.

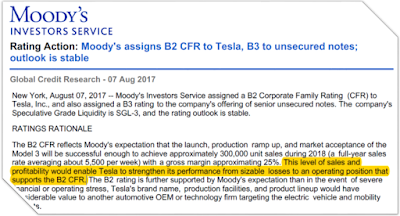

Moody’s rating rationale reads as follows (with our emphasis added):

"The B2 CFR reflects Moody's expectation that the launch, production ramp up, and market acceptance of the Model 3 will be successful enough to achieve approximately 300,000 unit sales during 2018 (a full-year sales rate averaging about 5,500 per week) with a gross margin approximating 25%. This level of sales and profitability would enable Tesla to strengthen its performance from sizable losses to an operating position that supports the B2 CFR. The B2 rating is further supported by Moody's expectation than in the event of severe financial or operating stress, Tesla's brand name, production facilities, and product lineup would have considerable value to another automotive OEM or technology firm targeting the electric vehicle and mobility markets."

To use Moody's language, in short, the achievement of the goals "would enable" Tesla to achieve the rating being provided now! Moody's has assumed a future, rosier picture of the company, and based its current rating on the achievement of this rosy future, rather than waiting for the financial position to warrant the rating provided.

Yet in its own press release, Moody’s rating analyst Bruce Clark (Senior VP) notes that "The major

challenge facing the company during the next twelve months will largely be the considerable execution risks associated with the rapid ramp up in production of a totally new vehicle."

So, why not see if Tesla can execute before rating Tesla B2, if the B2 rating is contingent on execution at a level far beyond what Tesla has ever yet achieved? The answer, unfortunately, is that had they looked at Tesla’s actual then-current balance sheet, they would never have rated them B2, but probably in the Caa range. And Tesla might have gone elsewhere for its second rating (it landed up getting a B- rating from S&P) or scratched the idea of issuing this bond. In fact, Moody’s essentially acknowledges this pressure, which to us seems to be a potential conflict of interest: “Without the proceeds from the [proposed] note offering, Tesla's liquidity position would be stressed.”

Moody’s didn’t exactly mark Tesla to market did it? Moody’s marked them to an optimistic future.

It does make one wonder where the Moody’s opinion lies if Moody's is simply going to take Tesla's management’s assumption as a given. A good job, if you can get it, but hardly an insightful opinion.

As it happened, towards the end of March Moody’s noticed that Tesla was still far away from achieving its optimistic goals, having suffered some production hurdles and delays not atypical for a young company producing a new vehicle.

Moody’s downgraded the so-called “long-term” ratings in March 2018, a little more than half a year after the bonds were issued. The long-term ratings were ultimately based on very short-term expectations. Click, whirr.

"[Moody’s downgrade of] Tesla's ratings reflect the significant shortfall in the production rate of the company's Model 3 electric vehicle. The company also faces liquidity pressures due to its large negative free cash flow and the pending maturities of convertible bonds ($230 million in November 2018 and $920 million in March 2019). Tesla produced only 2,425 Model 3s during the fourth quarter of 2017; it is currently targeting a weekly production rate of 2,500 by the end of March, and 5,000 per week by the end of June. This compares with the company's year-earlier production expectations of 5,000 per week by the end of 2017 and 10,000 by the end of 2018."

Oddly, now Moody’s is no longer hinging its rating to Tesla's current expectations: “The rating could be raised if production rates of the Model 3 meet Tesla's current expectations and if the company maintains good liquidity.”

Bondholders ought to be frustrated. They have bought into a B2 corporate family rating of a company which clearly wasn’t yet B2 at the time of the issuance. They may well have taken Caa-like risk, but only been compensated for the taking of single B risk.

Tesla has already been downgraded, and it is arguable whether the new B3 rating is well-founded, too. The bonds have been downgraded from B3 to Caa1 and have lost roughly 3% in value on the day of the downgrade. Altogether, the bonds are down roughly 10% in price terms since issuance.

--------------------------------------------------------------------------------------------------------------------

PF2 would like to thank Joe Pimbley for his contribution to this article.

No comments:

Post a Comment