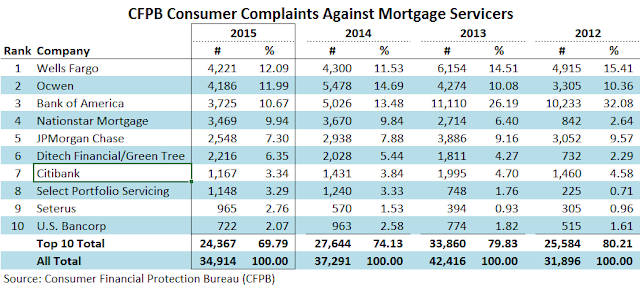

It's mid-February already, and now that the numbers are out it's time for our annual update on mortgage servicing complaints – which are handsomely down for the second year running: the number of complaints to the CFPB for the calendar year 2015 declined 6% from 2014

levels (vs. 12% decline from 2013 to 2014).

Ocwen, the mortgage servicer that's perhaps been most regularly under the microscope, saw

its number of customer complaints decrease by a mammoth 1292, the largest absolute

improvement. However, by our calculations in 2015 Ocwen sold

roughly $89 billion in mortgage servicing rights (MSRs), reducing the size of its MSR

portfolio by 22%, in terms of unpaid principal balance (UPB), notwithstanding

any runoff. So, Ocwen’s decrease in

complaints appears to be roughly in line with its more modestly sized servicing

assets.

Within 2015’s top 10 (complaints-wise), only Ditech

Financial/Green Tree and Seterus experienced an increase in complaints. Ditech Financial LLC merged with Green Tree

Servicing last year (data in table reflect combined totals); both were

subsidiaries of Walter Investment Management Corp. and the combined entity

still is. Seterus is an IBM subsidiary –

it is unclear to us whether it enjoyed an improvement in market share that

might explain its 69% increase in complaints.

For the top 5, we also looked at complaints relative to total loans serviced, by UPB. We would prefer to consider the number of loans serviced instead of UPB but, alas, only Ocwen and BofA provide those numbers, and only as of 4Q14. Ocwen outpaces the group at 12 complaints per billion dollars of UPB serviced. It is possible that these five servicers have widely varying average loan servicing balances, although Ocwen’s and BofA’s are fairly similar ($160,387 and $162,617 per loan, respectively, as of 4Q14).